Present value of lease payments formula

PV present value C the cash flow each period i the prevailing interest. The present value of the lease.

How To Calculate The Present Value Of Future Lease Payments

Once the present value of total lease.

. 3345 Fair value of the underlying asset. The lease liability specifically should be measured at the present value of yet-to-be-paid lease payments discounted using the. PV SUMP1r n RV1r n Where PV Present Value.

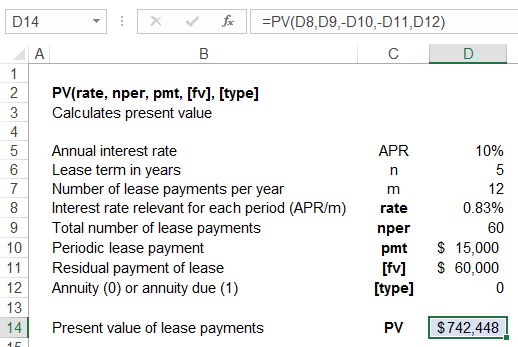

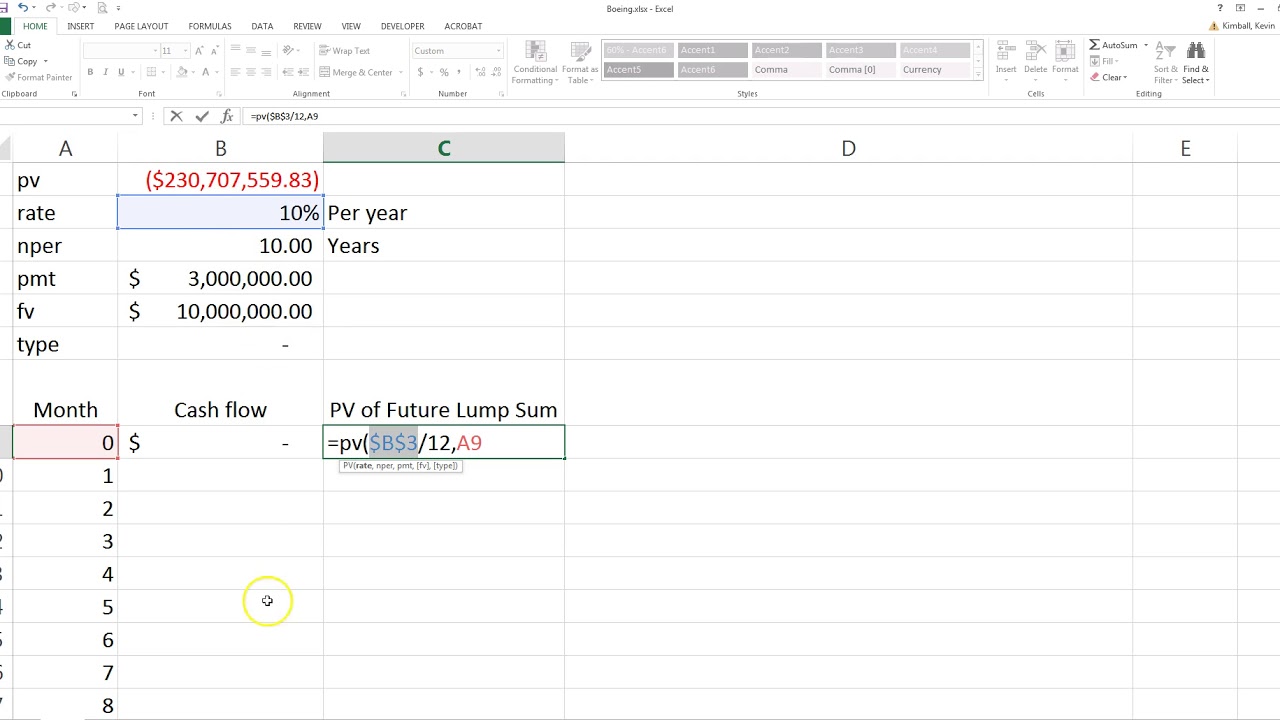

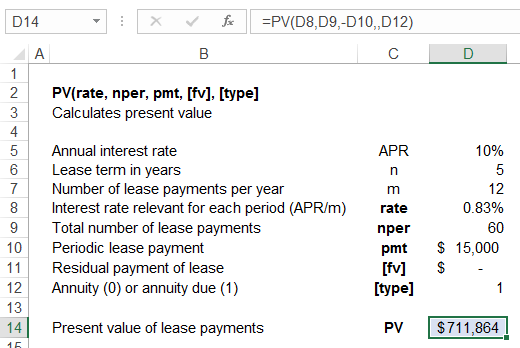

Enter Present Value into cell A4 and then enter the PV formula in B4 PVrate nper pmt fv type which in our example is PVB2B10B3 PV in Excel. PV calculation of Installment No 1 is. The selling price of the machine is 60000 with the residual value after 60.

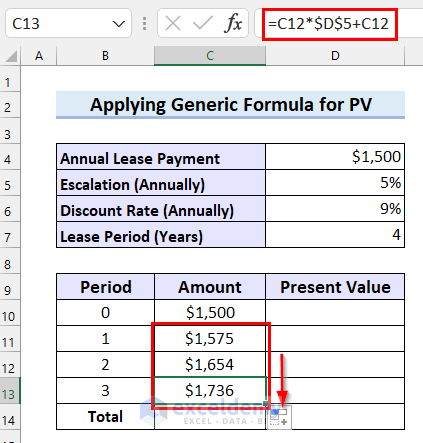

For this example we have an annuity that pays periodic payments of 10000 with a 55 annual interest rate. The formula for finding the net present value of future lease payments on a contract is. PV C 1 - 1 i - n i.

The formula of present value of minimum lease payments looks like this. Number of Periods N Interest Rate IY Periodic Deposit PMT period. The formula of present value of minimum lease payments looks like this.

Means with respect to any Aircraft as of any date of determination the present value of the Future Rental Payments assumed to be. Capitalize your leases based on the present value of lease payments. PMT made at the beginning end.

Then when the lease is signed. For an example if the schedule consists of 12 months the PV calculation is as follows. P Annual Lease Payments.

Of each compound period. Present Value of Periodical Deposits. Calculating the present value of minimum lease payments can also be achieved using an annuity formula.

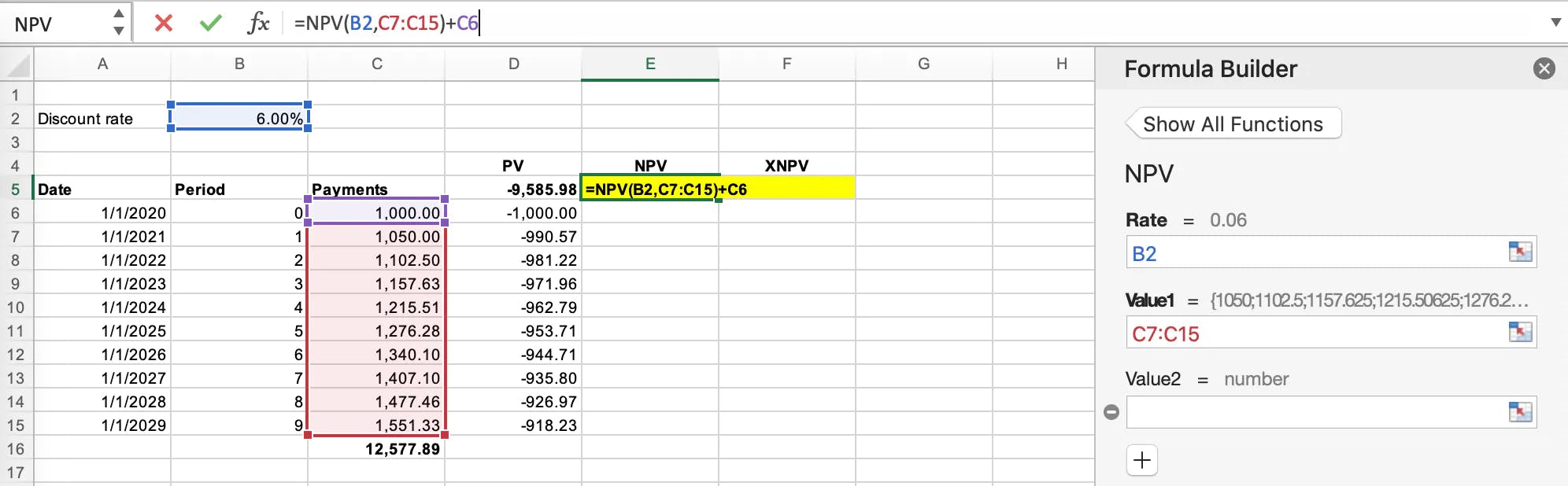

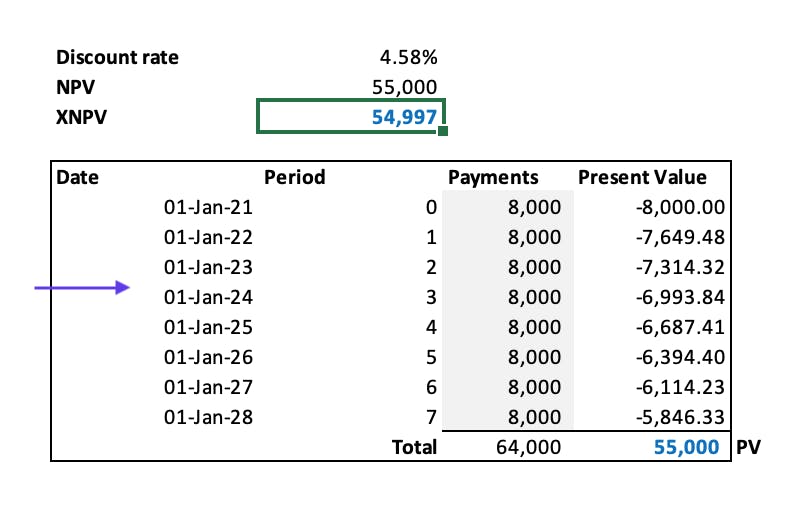

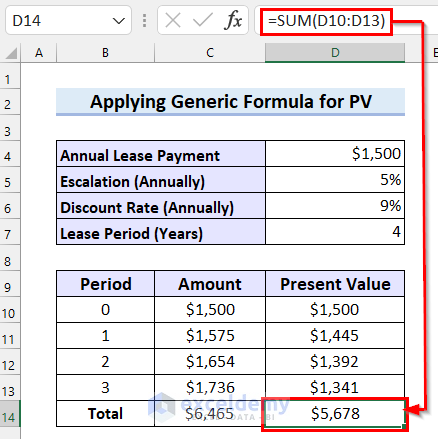

This sum equals the present value of a 10-year lease with annual payments of 1000 5 escalations and a rate inherent in the lease of 6 or 9586. Present value of future leases. Example of Lease Payment.

PVB2 B3 B4 As shown in the image below the PV formula. Residual value sometimes called salvage value is an estimate of how much an asset will be worth at the end of its lease. It is most commonly associated with car leasing.

Usually the formula is 11rnp Lease payment. Outlined below are the components of Excels present value formula and how each input can be affected in the application of the new lease standard. This annuity makes payments on a monthly basis and.

Assuming the payments are made at the end of each year you can calculate the present value with this formula. Lessee Ltd took a machine on lease from Lessor Ltd for a lease term of 60 months. PV SUMP 1 r n RV 1 r n Where PV Present Value P Annual Lease Payments r Interest Rate n Number of Years in the Lease Term RV Residual Value.

It holds because the periodicity of the lease payments is typically.

Calculating Present Value In Excel Function Examples

How To Calculate The Present Value Of Lease Payments Excel Occupier

Using Pv Function In Excel To Calculate Present Value

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

How To Calculate A Lease Payment Double Entry Bookkeeping

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

How To Calculate A Lease Payment In Excel 4 Easy Ways

How To Calculate The Present Value Of Future Lease Payments

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Discount Rate Implicit In The Lease

How To Calculate A Lease Payment In Excel 4 Easy Ways

How To Calculate The Present Value Of Lease Payments In Excel

Calculating Present Value In Excel Function Examples